By Sara Wilson

We are seeing real estate commentary around a declining market globally and nationally. Whilst Geelong is not immune to these headwinds, much of the commentary is around Geelong’s ability to better soften these impacts comparably to other areas. Headlines such as “Geelong market stays strong despite metro drops” and “the regional market is a national leader in the exodus to an affordable lifestyle” from independent real estate analyst Terry Ryder, show that we may just be lucky enough to swerve the massive price drops that are befalling metropolitan markets.

These are just educated predictions though, and we do need to be mindful that the most recent data may not accurately reflect what is happening in real time. Market shifts can happen quickly. The first signs of a shift is when buyer enquiry drops off, this has certainly happened, as prices became stable the competition is not as fierce across the board, in these times there is still opportunities to beat the market, however this becomes less common, average days on market increases as does the average vendor discount. Early in the year we were at the tail end of the pandemic boom where we saw a “Sellers’ market”, where the majority of the properties on the market sold quickly and for big prices.

By February/March 2022 the big price jumps and results that may have been achieved during 2020 and 2021 had softened. The media started to report a slight decline. Building construction costs increased, interest rate rises started and inflation fears began to bite. Midyear, the prices had flatlined into a balanced market or perceptively normal real estate market, and the media was reporting market drops and shifts.

Into the second half of 2022, we have the national media reporting real estate doom and gloom with rising interest rates being front and centre. This is where regional centers and capitals are starting to differentiate themselves. Given that the media is normally a couple of months behind reality, I want to share with you what we are currently seeing in the Geelong real estate market.

Three types of real estate markets

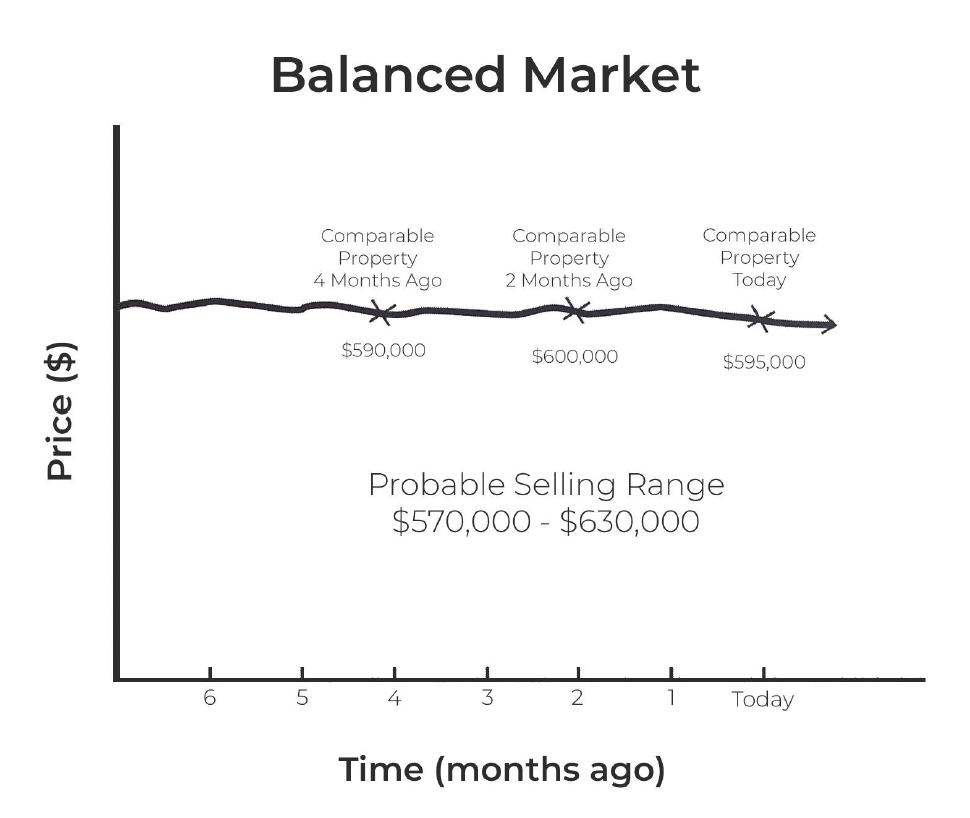

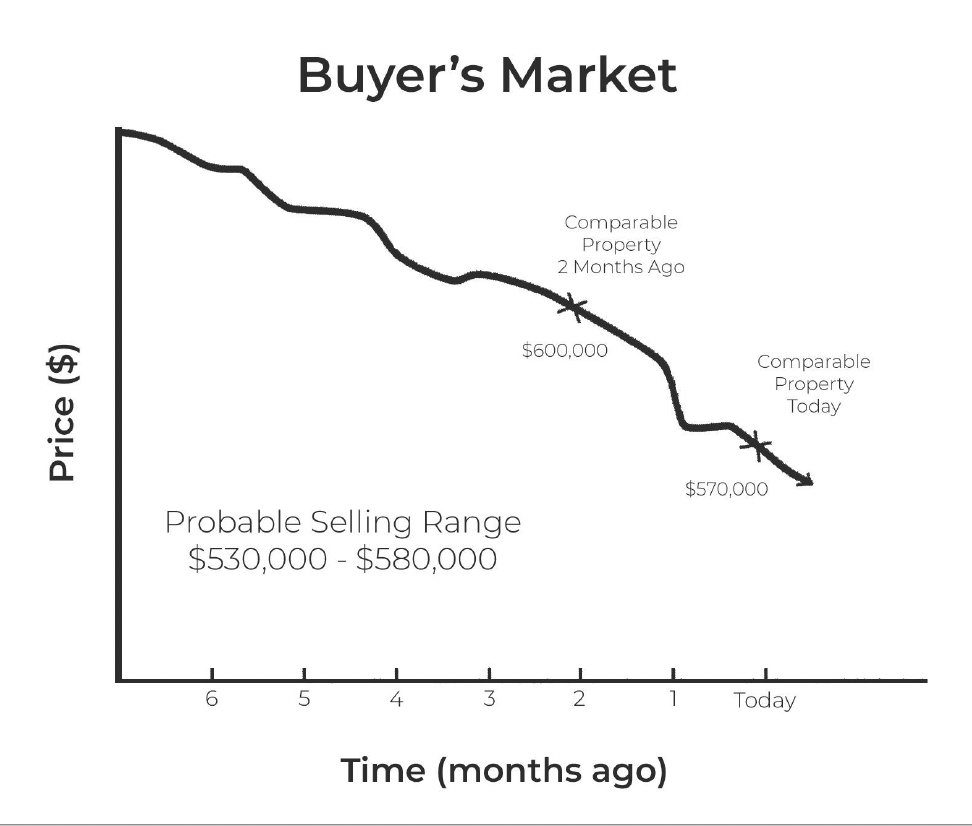

First, let me explain the three types of markets; The Buyers’ market, the Sellers’ Market and the Balanced market. The three graphs below provide an overview.

During the height of the pandemic, you could say we were in a Sellers’ market. The selling range for a property is broader today than it was two months ago. Homeowners could almost price ahead of the market with relevant marketing catching up to anything that was overpriced. It was more likely that such a property would beat the market.

The selling range is now broader than it was for the same property just months ago.

What we are seeing now in the Geelong property market

Right now in Geelong, based on the media commentary and the new statistical data that is coming to hand, we are in a Balanced Market, moving towards a Buyers Market. One of the key points as a seller now is that accurately pricing your property is more important than ever. This is when the probable selling range of a property is comparable (within 5%) to a similar property sold within a couple of months. As we head into to a “Buyers Market” The same house sold a couple of months ago will be worth more than now and those looking to sell need to recognize this and set their price accordingly. It is a counter intuitive position, that sometimes in order to get the highest price in todays market, owners need to price at what may seem like a low level compared with 6 months ago. At the very least, your pricing strategy should be reliant on and reactive to market feedback (recognizing that no feedback is sometimes the loudest). Current sellers need to make sure they are using very up-to-date comparative data for a point of reference, prior to going to market, then using up to date competitive data (buyer feedback) once on the market.

Are there less buyers?

Well, we say buyers, but what we should probably say is less browsers. While there can be less enquiry on a property, those who do enquire are usually more qualified. Most have their finance sorted already and are ready to purchase. We have also seen a new issue arise with a higher rate of finance conditions falling through. With the rise of interest rates, some buyers have had their finance approved or pre-approved 6-8 weeks ago, but when they come to buy and take a signed contract to their broker or bank who reassess their ability to service the loan, the finance is falling through. We have seen this happen a couple of times in the month. The banks have a higher buffer zone when doing their internal servicing numbers, so buyers who were meeting the buffer are now not.

Are buyers willing to renovate?

If a property needs a full renovation or serious maintenance, there was a time not long ago when it would have been marketed as a renovator’s delight. Now, with the rising price of building materials and the wait times required to secure tradespeople, the renovator’s delight is being seen as a high-risk investment.

Properties that were recently marketed as ‘a renovator’s delight’ are now considered high risk.

What’s the best way to sell your house right now in Geelong?

There are four main pieces of the puzzle to solve when putting your property on the market:

- The Right Agent

- Quality Marketing

- Property Presentation

- The Right Price

The importance of accurate pricing

Having three out of four pieces of the puzzle in place can lead to a good result. With the right agent, quality marketing, and the right price, even a property that is trashed will sell. However, try this; swap out the trashed house for an immaculate one but get the price wrong, you still have three out of four, but no sale. Today, people simply won’t buy overpriced things.

The internet creates a digital footprint, a record of a property’s advertising and pricing history for all to see. A footprint intensifies the danger posed by an extended marketing period. If a property is launched onto the main real estate portals at an inflated price and doesn’t sell, significant long-term damage occurs to the property’s recorded history and the eventual selling price.

Our prediction

We believe that the market here in Geelong won’t crash, BUT houses are more likely to sell at the lower end of the estimated pricing range, which makes accurate pricing critical. If you are considering selling your property or currently have your property on the market the first thing to do is collect as much information about accurate pricing as you can before your property is publicly released. Due Diligence here is important. A reminder here also that agents may not be the best people to listen to when considering the value of your property. I know that sounds weird coming from an agent, but it is VERY common for agents to inflate the estimated value to property owners. It is one of the biggest traps in real estate. The estimated price will be inflated (or avoided) so they get your business. Be very careful of this when selecting your agent and don’t select an agent based just on the price quoted.

Being realistic about pricing your Geelong property is critical.

Our best advice? Be realistic about pricing.

Sellers need to set their expectations in line with the current market that does not live in the pandemic-driven boom. Once your property is on the market, listen to the feedback from the buyers. They will soon tell you if it is priced too high. If your house goes on the market, and you have no enquiry and therefore no inspections, it commonly means the price is too high. If you have enquiry and inspections and no offers, again, your price is too high. If you have genuine enquiry, inspections and interest to purchase the property, then you have hit the sweet spot. Do not be afraid of altering the price of the property as your campaign moves along based on the levels of enquiry/inspections. This can mean the difference between your property sitting on the shelf for a long period and having its reputation damaged OR signing a contract of sale, popping a bottle of champagne and moving on to your next venture. Like most things in life, living in the moment and future is always better than living in the past.

If you are after proven, pragmatic feedback and information about selling in the current market, give us a call at the office today on 03 5292 8084. If you would like a copy of the booklet 7 QUESTIONS TO ASK WHEN INTERVIEWING AGENTS please email me.

Kardinia Property, sell SMART.